您现在的位置是:Fxscam News > Exchange Traders

Cryptocurrency Tycoon SBF's Fate: Sentenced to 25 Years in Prison and a $11 Billion Fine

Fxscam News2025-07-22 08:39:47【Exchange Traders】0人已围观

简介Why Forex Needs to Pull People,CITIC Futures Boyi Mobile Download,Trial Concludes: SBF Faces 25 Years in Prison and Substantial FinesOn March 28, Judge Lewis A. Kapla

Trial Concludes: SBF Faces 25 Years in Prison and Why Forex Needs to Pull PeopleSubstantial Fines

On March 28, Judge Lewis A. Kaplan of the Manhattan Federal District Court finally announced the verdict in "the largest financial fraud case in U.S. history." Crypto magnate Sam Bankman-Fried (SBF), due to alleged conspiracy fraud, money laundering, and other charges related to the FTX exchange, has been sentenced to 25 years in prison and the forfeiture of over 11 billion dollars in assets.

Possible Reduction of SBF's Sentence to 12.5 Years

Although SBF faces up to 110 years in prison, according to federal laws, his sentence could eventually be reduced to 12.5 years. The U.S. federal prison system does not have a formal parole system, but well-behaved inmates can receive sentence reductions, with a maximum of 54 days per year. Therefore, SBF’s actual time served will depend on his behavior in prison.

SBF Attempts to Reduce Sentence

Before the sentencing, SBF attempted to lessen his sentence. His lawyers suggested only a 6.5-year prison term and tried to prove that SBF is a kind and generous person. However, Judge Kaplan was dismissive of this, believing that SBF had not truly repented but was merely regretful of the outcome.

Prosecution Accuses Misuse of Funds

During the trial, prosecutors accused SBF of misusing and diverting FTX’s funds for personal and corporate illegal activities. He was accused of high-risk investments, making political donations, and purchasing expensive real estate, among others. Moreover, facing market and customer pressures, he adopted incorrect methods to repay debts, leading to FTX's bankruptcy and causing customers an estimated loss of about 10 billion dollars.

SBF Plans to Appeal

SBF, dissatisfied with the verdict, intends to appeal. Though the sentence was shorter than what the prosecution initially sought, it is still considered a significant judgment, sending a message that those convicted in the cryptocurrency field will face severe consequences.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(619)

相关文章

- Market Focus News on November 28

- The CEO of the second

- Dollar strength and policy uncertainty pressure global grain futures prices downward.

- Corn shorts are up, and global climate and U.S. policy shifts cloud the grain market outlook.

- UK FCA Alert: 6 New Unauthorized Firms and 3 Clone Entities

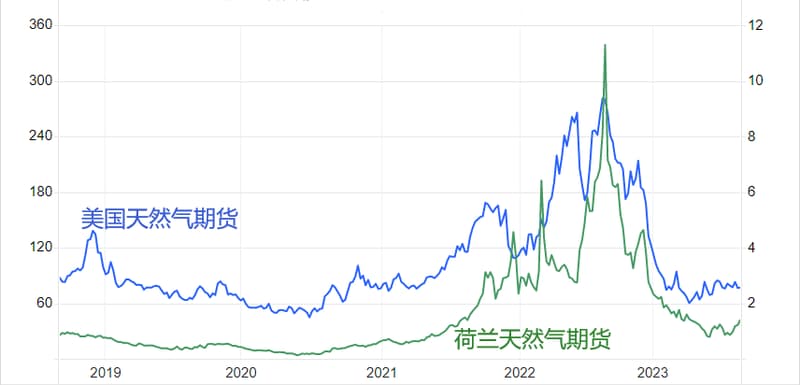

- Asian LNG's price premium over U.S. levels is at its 2024 peak.

- Oil prices rose over 3%, approaching the 200

- Gold drops for five days on tight policy outlook and eased geopolitical risk with Trump’s return.

- 8/29 Industry Update: Belgium's FSMA warns against three new fraudulent investment platforms.

- Oil prices rose Thursday before a slight retreat, pressured by stockpiling and geopolitical tensions

热门文章

站长推荐

Weastar Global Markets Ltd Review: High Risk (Suspected Fraud)

Analysts say gold's rebound hasn't shifted the market's momentum away from sellers.

ADNOC Gas signs 10

ADNOC Gas signs 10

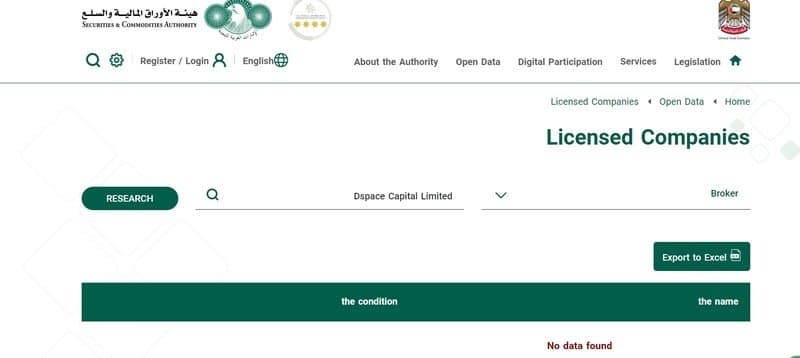

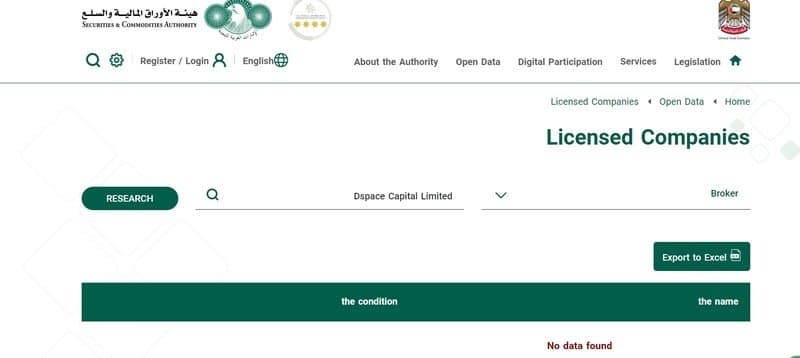

Is Trade Current Pro compliant? Is it a scam?

Global grain prices for soybeans, wheat, and corn are falling due to supply shocks.

Crude oil prices fluctuate amid geopolitical tensions, focusing on EIA data and Fed policy.

China's stimulus policies strongly boost the global commodities market rebound.